does north carolina charge sales tax on food

Whether you have to pay sales tax on Internet purchases is a common question in a world where consumers buy everything from clothes to food to cars online. 612 Part II Section 74A.

Everything You Need To Know About Restaurant Taxes

Indeed many online retailers often lure customers in by advertising that any purchases made will be free from sales.

. Manufactured and modular homes and aircraft and qualified jet engines are taxed at just the state rate of. Colorado has 560 special sales tax jurisdictions with local sales taxes in. 612 Part II Section 74A.

It must be noted that if the charge is included by a manufactured homes dealer to the propertys. How South Dakota v. The majority of South Carolinas 46 counties charge a local sales surtax.

If the shipping charge is not stated separately then it is considered to be a part of the taxable transaction and the seller is required to collect sales tax. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. Some people view the Internet as the prime place to start selling items that are free from sales tax.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. Several exceptions to this tax are burial caskets prescription medicine certain types of groceries medical devices modular or manufactures homes certain agricultural items manufacturing equipment and printed publications. The state sales tax on the sale of most motor vehicles is capped at 300.

In the state of Wisconsin sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Products which are specifically exempt from sales tax include some food and drinks medical products and medicines hygiene products and more. But North Carolina does charge the 2 or 225 percent local sales tax on qualifying food exempting food purchases only from the statewide sales tax and the transit tax.

For instance most states exempt groceries from the sales tax others tax groceries at a limited rate and still others tax groceries at the same rate as all. States can vary greatly in this regard. Make Your Money Work.

South Carolina OTC medicines are exempt from tax when they are sold to a health care clinic that provides medical care without charge to its patients. Wayfair decision means that your online business is now liable for paying sales tax on orders made in states and counties where you do not have a physical presence. The words terms and phrases defined in this article have the meaning provided except when the context clearly indicates a different meaning.

Groceries and prescription drugs are exempt from the Colorado sales tax. Texas OTC medicine is exempt if it is required to be labeled with a Drug Facts panel by. Additional surtaxes may also be collected on the sale of prepared food in some counties.

The South Dakota v. Wayfair affected economic nexus. This report ranks states and cities based on tax rates and does not account for differences in tax bases the structure of sales taxes defining what is taxable and nontaxable.

Some cities levy additional taxes on prepared food and liquorwith total taxation as high as a 165 on mixed drinks in Myrtle Beach. Essentially you are not required to collect sales tax on shipping charges so long as the charge is stated separately on the invoice. For the first time states would be able to charge sales tax to companies that didnt have a physical presence within the state.

A number of categories of goods also have different sales tax rates. This chapter may be cited as the South Carolina Sales and Use Tax Act. Threshold of 100000 per year in gross revenue or more than 200 transaction in the current or prior year.

![]()

Prepared Food Beverage Tax Wake County Government

Is Food Taxable In North Carolina Taxjar

State By State Click Through Nexus Guide

Is Food Taxable In North Carolina Taxjar

Exemptions From The North Carolina Sales Tax

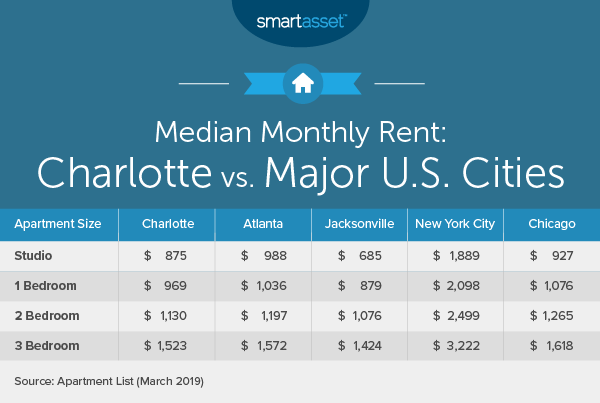

The Cost Of Living In Charlotte North Carolina Smartasset

States With Highest And Lowest Sales Tax Rates

North Carolina State Taxes Everything You Need To Know Gobankingrates

Sales Tax On Grocery Items Taxjar

Is Food Taxable In South Carolina Taxjar

North Carolina Sales Tax Small Business Guide Truic

South Carolina Sales Tax Rate 2022

Meal Plan Options Student Meal Plans Uncw

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation